Does Cryptocurrency Have a Place In Your Portfolio?

Has all the attention to “Bitcoin” and “cryptocurrency” got you wondering what all the fuss is about? The news around this is hard to ignore, so we thought we’d take a closer look. Although this will be a bit more technical, I hope it’s helpful as you continue to hear about this topic.

Our quick take? Cryptocurrency is an interesting development with a number of promising possibilities. Human ingenuity is always a marvel to behold. But like any relatively new, highly volatile pursuit, it entails considerable risk. If by chance you’ve thought of trading in it for fun or profit, we advise against putting in any more than you could afford to lose entirely. In our estimation, cryptocurrency remains more of a speculative venture than a disciplined investment.

With that, let’s take a look. > SEE MORE

Posted by:

Waypoint Wealth Management

Election Worries?

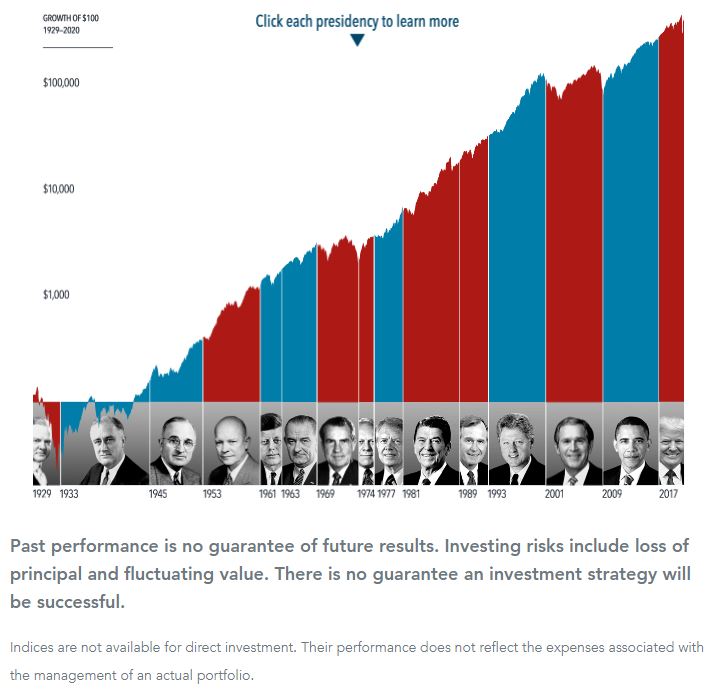

2020 has already had more twists and turns than an HBO special. From the onset of the pandemic and the ensuing economic/financial downturns, to the equally as surprising robust market upturn, to the unknowns over the upcoming election, 2020 is in the record books already.

And we have (understandably) never heard as much concern from clients as we have with the upcoming presidential election.

If that is you, this is a good time to step back, take a deep breath, and ask ourselves two important questions:

Question #1: How much impact does the president have on stocks?

To answer this question, let’s review the evidence. Click on the image below from our friends at DFA, to take a look for yourself at how markets and the economy performed under each president (and also showing who had control of the Senate and House at the time!).

Posted by:

Waypoint Wealth Management

Which Path Would You Take?

“I don’t know…something just doesn’t feel right,” you mumble through your mask to your primary care doctor while sitting on the examination table under a flickering fluorescent light in a room decorated with anatomical charts and hand-sanitizer dispensers. After listening to your heart and your lungs, the doctor diagnoses your feelings of worry as a mild condition that is easily treatable but could become serious if a proper treatment regimen isn’t followed. The doctor gives two treatment plans: one coming from the New England Journal of Medicine and the other from a health magazine that can be purchased at your local convenience store. Which plan do you choose?

The health magazines are filled with tips and tricks, such as how to burn body fat, jump-start the body’s metabolic rate, and build immune system strength. And they might even work sometimes. If you want to choose the treatment plan with the highest odds of success, it might give you more confidence to know that the medical journal, and its recommendations, are based on decades of data collected from research studies performed by medical experts and peer-reviewed by the medical community.

We face the same decision when it comes to investing. > SEE MORE

Posted by:

Waypoint Wealth Management

The (Not So) Trivial Pursuit of Financial Contentment

Here’s some fun trivia for you to share with your friends as we head into the weekend:

Did you know you have to count to 1,000 before you’ll find the letter “a” in a spelled-out number?

We thought you could use that break from the deluge of mid-year news events and stock market commentaries on 2020’s bipolar extremes. The general theme has been how quickly global markets sold off and came back – even as economic and sociopolitical headlines continued to stoke bonfires of ongoing upheaval.

And the year is only half over. > SEE MORE

Posted by:

Waypoint Wealth Management

What Has Historically Followed A Time Like This?

Having patience can be challenging when recent downturns have occurred. But the reality is that some of the biggest innovations (and opportunities) arise out of difficult times. And when it comes to investing, all we have is what those opportunities might bring us in the future. This is why investing can be hard when focusing on short-term movements for your long-term retirement plan.

We can’t go back in time and change the past, but we can return to the evidence, and review what has occurred each time. And while not perfect or any guarantee, we can put the odds in our favor to grow over time.

Our partners at Dimensional put this visual together (below) showing how returns have averaged coming out of downturns of -10%, -20%, and -30%. Please take a look as a reminder of how having a longer-term outlook has helped investors in times like these – to not only stay on course but also to be confident in what can lie ahead. > SEE MORE

Posted by: