You, Your Retirement, and the SECURE Act

You may have missed the news – buried in a much bigger spending bill and passed in the thick of the holiday season. But after months of nearly bringing it to the finish line, it’s now official: the Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law.

The SECURE Act provides a mixed bag of incentives and obligations for retirement savers and service providers alike. Its intent is to make it easier for families to save more for retirement.

That said, “easier” doesn’t necessarily mean less complicated. The following is an overview of the most significant changes that we see for you (our clients), as the SECURE Act starts rolling out in 2020.

Tax-Favorable Retirement Saving

Compared to previous generations, more Americans are living longer, remaining employed into their 70s, and shouldering more of the duty to fund their own retirement. As such, the SECURE Act includes several incentives to start saving sooner and keep saving longer.

- Initial RMD increases to age 72 – Until now, you had to start taking Required Minimum Distribution (RMDs) out of retirement accounts at age 70 ½. RMDs are then taxed at ordinary income rates. Now, you don’t need to begin taking RMDs until age 72. However, if you turned 70 ½ in 2019 or earlier there is no change; the new rules begin for those turning 70 ½ in 2020. Rules for qualified charitable distributions (QCDs) and Roth IRA withdrawals remain unchanged.

- IRA contributions for as long as you’re employed – If you work past age 70 ½, you can now continue to contribute to either a Roth or a traditional IRA. Before, you could only contribute to a Roth IRA after age 70 ½.

- Expanded participation for long-term, part-time employees – Even if you’re a part-time employee, you may now be able to participate in your employer’s 401(k) plan.

Posted by:

Waypoint Wealth Management

If You Ever Needed More Evidence To Properly Diversify…

We’ve said it before. There is nothing better than seeing a few concise, clear pictures that demonstrate (again) why as investors we follow the path we do. Dimensional Fund Advisors (DFA) recently came out with a piece that may help you to remember what we absolutely believe to be true. That is (in their words):

- Returns can vary sharply from one period to another

- Holding a broadly diversified portfolio can help smooth out the swings, and

- Focusing on known drivers of higher expected returns can increase the potential for long-term success

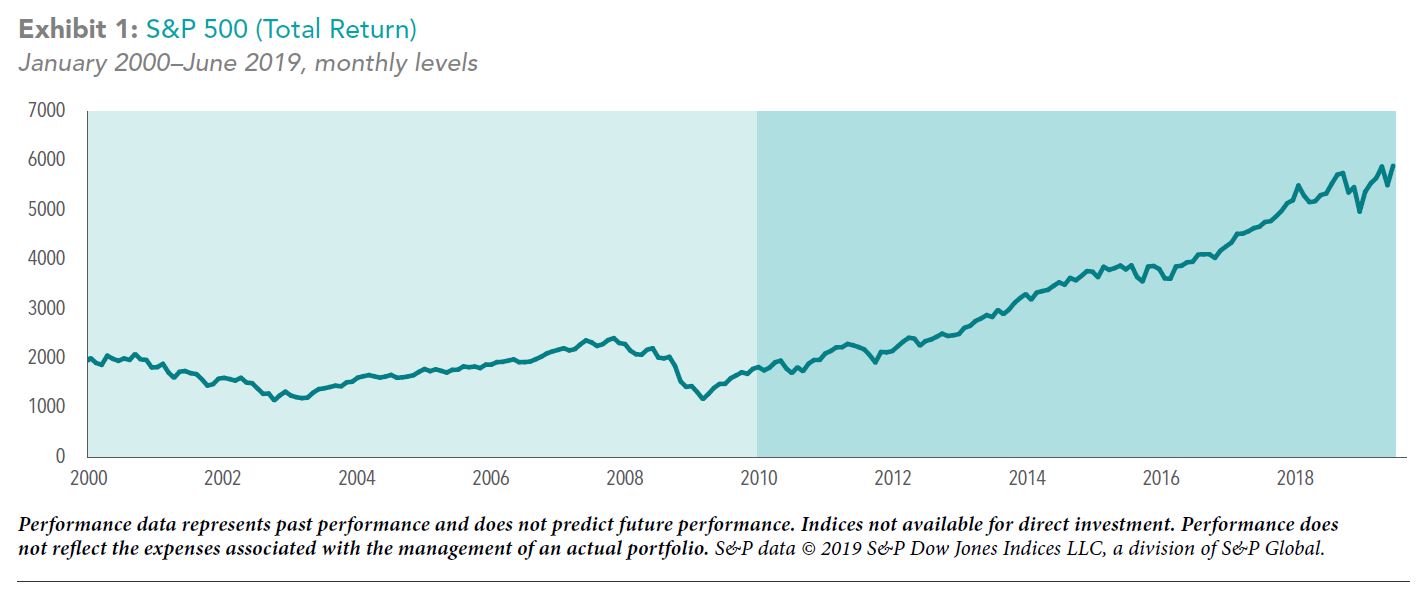

Reminders like this can also help us to answer certain questions we should naturally have from time to time. Questions such as “why would I continue to hold an investment that (in the short-term) has simply stunk?” To understand this more, let’s first start by looking at US Stocks (S&P 500) in the first decade of the 21st century (2000-2009) versus the second (2010 until June 2019). Note that you can click on each image to see a larger view:

If you’re like me, you may be glad that US Stocks are held in portfolios in some way, given their run over the last ten years. But what concerns me more is seeing that first decade (at left). What if US stocks go through a long period of time like this, and you’re just beginning to take income now from your portfolio? > SEE MORE

Posted by:

Waypoint Wealth Management

What’s the Point of a “Point”?

We’ve often said that watching the market every day has little (if any) benefit to you as a long-term investor. However, we can’t help but hear or read headlines such as “Dow rallies 500 points” or “Dow drops 500 points.” These types of stock movement headlines may make little sense to some investors, given that a “point” for the Dow and what it means to an individual’s portfolio may be unclear. Also, events such as a 500-point move do not have the same impact on performance as they used to. With this in mind, let’s take a look at what a point move in the Dow means and the impact it may have on an investment portfolio.

Impact of Index Construction

The Dow Jones Industrial Average was first calculated in 1896 and currently consists of 30 large cap US stocks. The Dow is a “price-weighted” index, which is different than more common “market capitalization-weighted” (which is simply a product of its stock price and shares outstanding) indices.

An example may help put this difference in methodology in perspective. Consider two companies that have a total market capitalization of $1,000. Company A has 1,000 shares outstanding that trade at $1 each, and Company B has 100 shares outstanding that trade at $10 each. In a market capitalization-weighted index, both companies would have the same weight since their total market caps are the same. However, in a price-weighted index, Company B would have a larger weight due to its higher stock price. This means that changes in Company B’s stock would be more impactful to a price-weighted index than they would be to a market cap-weighted index. > SEE MORE

Posted by:

Waypoint Wealth Management

What Are Three Ways That You (And We) Can Stay On Course?

We don’t expect people to fly their own airplanes or take out their kids’ appendixes, and yet we expect them to manage their retirement portfolios. In my careers I’ve done all three, and investing is by far the hardest.”

The Four Pillars of Investing

If we were to picture your retirement financial plan as an airplane flight, your investments are the trade winds carrying you toward your destination. How you invest can mean the difference between your arrival at your desired location … or it can knock you into a tail-spin.

To help you stay on course toward your own goals, we offer the “compass” of a solid investment strategy based on three key points. First, we have a strategy. Second, it’s a strategy based on reason and evidence guided by the durable science of capital markets. Third, it’s grounded in our fiduciary obligation to serve our clients’ highest financial interests. > SEE MORE

Posted by:

Waypoint Wealth Management

What’s THE Most Important Thing You Can Do To Prepare For Retirement?

I was thinking about this question while reading an article a client sent to me. You can find the write-up here, and it’s a helpful “countdown to retirement” with many tips to consider as you approach retirement. As I looked through the list and thought about covering these issues with our own clients over the years, the question came to mind: what is the most important financial planning step you can take to feel great about your retirement plan?

It’s really a tough question since there are a lot of important issues to consider when “taking the leap” away from a career that you’ve had for so many years. Topics such as health insurance, do you have enough saved, are you invested properly, Social Security timing and others are obviously important to explore. There’s also the softer part of the equation: how will you spend and enjoy your time? Should you still work? How will you miss the social aspect of working and contributing?

But if I were forced to answer, what would I say is the most important question? That’s when I realized it’s the one that I have been recommending most lately when helping someone plan for retirement. It’s this simple question: how much do you need to live on (and how sure are you of that?)? > SEE MORE

Posted by:

Pete Dixon, CFP®

Partner and Advisor