Does Cryptocurrency Have a Place In Your Portfolio?

Has all the attention to “Bitcoin” and “cryptocurrency” got you wondering what all the fuss is about? The news around this is hard to ignore, so we thought we’d take a closer look. Although this will be a bit more technical, I hope it’s helpful as you continue to hear about this topic.

Our quick take? Cryptocurrency is an interesting development with a number of promising possibilities. Human ingenuity is always a marvel to behold. But like any relatively new, highly volatile pursuit, it entails considerable risk. If by chance you’ve thought of trading in it for fun or profit, we advise against putting in any more than you could afford to lose entirely. In our estimation, cryptocurrency remains more of a speculative venture than a disciplined investment.

With that, let’s take a look. > SEE MORE

Posted by:

Waypoint Wealth Management

Your Retirement Income Strategy

If you are like us, you plan and hope for a retirement unhindered by financial worries. Plan as we might, we all will at some point encounter the unpredictable during our retirement. Strong income planning and a buttoned-up strategy for cash flow going into retirement will help give you flexibility when the inevitable surprise pops up, allowing you to weather incoming storms and enjoy a successful retirement.

The Age-old Question: Do I Have Enough?

Making the change from saver to spender is a financial and mental hurdle that must be addressed to be in tune with your financial life. There is no magic switch to flip to make this transition easy. However, creating a spend-down plan and paycheck replacement strategy will help you map out your path. > SEE MORE

Posted by:

Waypoint Wealth Management

Election Worries?

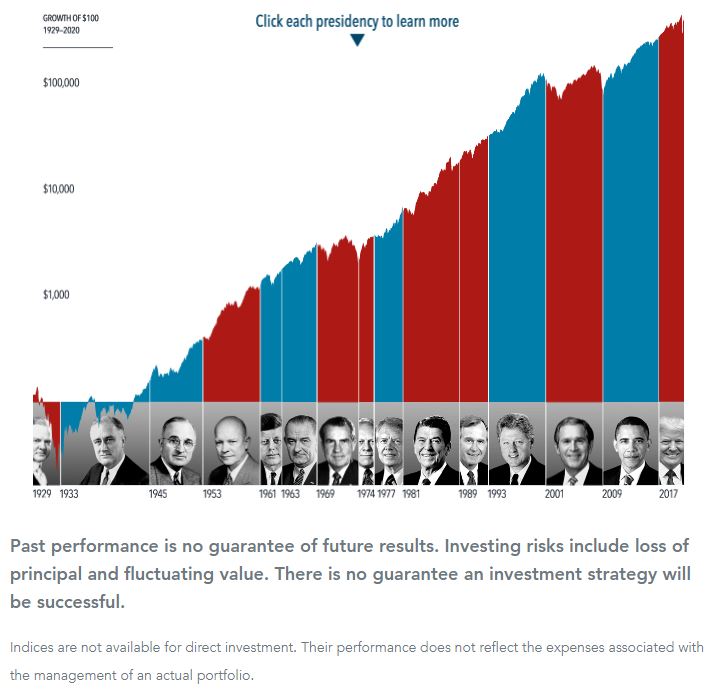

2020 has already had more twists and turns than an HBO special. From the onset of the pandemic and the ensuing economic/financial downturns, to the equally as surprising robust market upturn, to the unknowns over the upcoming election, 2020 is in the record books already.

And we have (understandably) never heard as much concern from clients as we have with the upcoming presidential election.

If that is you, this is a good time to step back, take a deep breath, and ask ourselves two important questions:

Question #1: How much impact does the president have on stocks?

To answer this question, let’s review the evidence. Click on the image below from our friends at DFA, to take a look for yourself at how markets and the economy performed under each president (and also showing who had control of the Senate and House at the time!).

Posted by:

Waypoint Wealth Management

3 Principles That Round Out Our Strategy

In recent years, U.S. stocks have outperformed international stocks and growth stocks have outperformed value stocks, and this has led many to question the benefits of diversification. We should begin with a look at the appropriate lens through which to view investment strategy performance. Then we will address several issues that work to fog our lens and challenge our ability to stay the course. Taken together, we believe an understanding of these topics fosters the mindset necessary to remain disciplined in the face of adversity.

Posted by:

Waypoint Wealth Management

Which Path Would You Take?

“I don’t know…something just doesn’t feel right,” you mumble through your mask to your primary care doctor while sitting on the examination table under a flickering fluorescent light in a room decorated with anatomical charts and hand-sanitizer dispensers. After listening to your heart and your lungs, the doctor diagnoses your feelings of worry as a mild condition that is easily treatable but could become serious if a proper treatment regimen isn’t followed. The doctor gives two treatment plans: one coming from the New England Journal of Medicine and the other from a health magazine that can be purchased at your local convenience store. Which plan do you choose?

The health magazines are filled with tips and tricks, such as how to burn body fat, jump-start the body’s metabolic rate, and build immune system strength. And they might even work sometimes. If you want to choose the treatment plan with the highest odds of success, it might give you more confidence to know that the medical journal, and its recommendations, are based on decades of data collected from research studies performed by medical experts and peer-reviewed by the medical community.

We face the same decision when it comes to investing. > SEE MORE

Posted by: