A Closer Look At Dividends

When generating income for retirement, we take what we call a “total return” approach. Simply put, this is using both the income derived from the investments (from interest and dividends) as well as the investment’s potential gain in price over time. When going about it this way, we can diversify across many investments and we can also put you in the driver’s seat by customizing your income to meet your goals.

One strategy that we hear of often is solely living on an investment’s “dividend”, and attempting to not sell any shares along your retirement journey. However, while dividends can be important, we think they’re just one piece of the overall income puzzle. > SEE MORE

Posted by:

Waypoint Wealth Management

You, Your Retirement, and the SECURE Act

You may have missed the news – buried in a much bigger spending bill and passed in the thick of the holiday season. But after months of nearly bringing it to the finish line, it’s now official: the Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law.

The SECURE Act provides a mixed bag of incentives and obligations for retirement savers and service providers alike. Its intent is to make it easier for families to save more for retirement.

That said, “easier” doesn’t necessarily mean less complicated. The following is an overview of the most significant changes that we see for you (our clients), as the SECURE Act starts rolling out in 2020.

Tax-Favorable Retirement Saving

Compared to previous generations, more Americans are living longer, remaining employed into their 70s, and shouldering more of the duty to fund their own retirement. As such, the SECURE Act includes several incentives to start saving sooner and keep saving longer.

- Initial RMD increases to age 72 – Until now, you had to start taking Required Minimum Distribution (RMDs) out of retirement accounts at age 70 ½. RMDs are then taxed at ordinary income rates. Now, you don’t need to begin taking RMDs until age 72. However, if you turned 70 ½ in 2019 or earlier there is no change; the new rules begin for those turning 70 ½ in 2020. Rules for qualified charitable distributions (QCDs) and Roth IRA withdrawals remain unchanged.

- IRA contributions for as long as you’re employed – If you work past age 70 ½, you can now continue to contribute to either a Roth or a traditional IRA. Before, you could only contribute to a Roth IRA after age 70 ½.

- Expanded participation for long-term, part-time employees – Even if you’re a part-time employee, you may now be able to participate in your employer’s 401(k) plan.

Posted by:

Waypoint Wealth Management

Factoring In “Intuition”

When we’re discussing our investment philosophy, we love to hear questions that open up more around why we invest the way we do. Because the reality is that most individual investors don’t really even have an investment philosophy beyond trying to get the best return.

Occasionally during these conversations, we talk about how we pursue “factors” of return that are persistent, pervasive, robust, implementable and intuitive. We wanted to briefly cover what these mean, and especially the one labeled “intuitive”. How could intuition have anything to do with an investment philosophy?

First off, how do we define what we mean by a “factor” of return? > SEE MORE

Posted by:

Waypoint Wealth Management

Can You Relate To Any of The “Five Stages of Retirement”?

“Retirement is a journey with five distinct stages, and some people get stuck. Understand them, know which stage you are in, and know how to move forward.” -Alan Spector

I recently attended a conference where I had the privilege to hear from author Alan Spector. He and his partners interviewed hundreds of retirees to discover what creates a fulfilling retirement and wrote a book (or a guide, really) to help others with this life transition. It has numerous stories, exercises, and questions to assist with the non-financial, “life planning” aspect of retiring. Since most of you (our clients) are in or nearing retirement, this is something that I have a deep interest in as well. There are so many great takeaways and lessons the book provides, and I would highly encourage anyone interested to check it out (link here) and/or review their website (link here) to explore this for you or someone you know.

One of the enlightening sections of the book is the “Five Stages of Retirement.” I literally can see the faces of various clients across all stages when I read through these. As I share these with you, see if you can identify yourself with one of these stages (borrowed from the book, with permission from Alan): > SEE MORE

Posted by:

Waypoint Wealth Management

If You Ever Needed More Evidence To Properly Diversify…

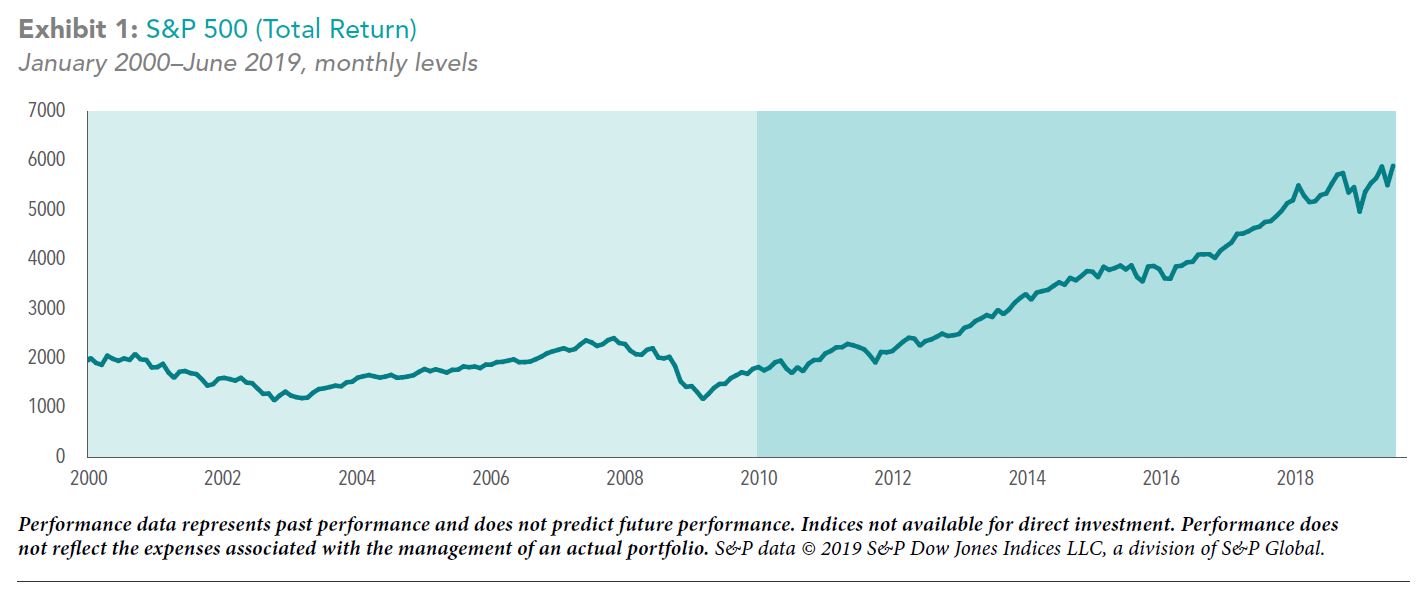

We’ve said it before. There is nothing better than seeing a few concise, clear pictures that demonstrate (again) why as investors we follow the path we do. Dimensional Fund Advisors (DFA) recently came out with a piece that may help you to remember what we absolutely believe to be true. That is (in their words):

- Returns can vary sharply from one period to another

- Holding a broadly diversified portfolio can help smooth out the swings, and

- Focusing on known drivers of higher expected returns can increase the potential for long-term success

Reminders like this can also help us to answer certain questions we should naturally have from time to time. Questions such as “why would I continue to hold an investment that (in the short-term) has simply stunk?” To understand this more, let’s first start by looking at US Stocks (S&P 500) in the first decade of the 21st century (2000-2009) versus the second (2010 until June 2019). Note that you can click on each image to see a larger view:

If you’re like me, you may be glad that US Stocks are held in portfolios in some way, given their run over the last ten years. But what concerns me more is seeing that first decade (at left). What if US stocks go through a long period of time like this, and you’re just beginning to take income now from your portfolio? > SEE MORE

Posted by: