Our Brain And Our Behavior, Part One

If you have ever watched a youth soccer game, you’ve seen it. Basically, the players observe where everyone is headed (towards the ball), and follow suit. It doesn’t matter where the ball is located on the field or what position the child is in–they’re going after it with all their might! While it’s cute to watch, this cluster of uniformed chaos creates a hive of activity and works against them, making it difficult to move down the field.

In soccer, this behavior becomes less of an issue over time as the player learns the sport. In the world of personal finance, this type of behavior is referred to as herd mentality, a type of “behavioral bias”, and may not go away over time. And unfortunately, your own behavioral biases are often the greatest threat to your financial well-being.

Posted by:

Waypoint Wealth Management

Can Budgeting Actually Be Rewarding?

Many people view budgeting as a never-ending exercise in self-denial, characterized primarily by the word “no”. But it doesn’t have to be that way.

Instead, think about budgeting as the connective tissue between where your money is going this week, this month or even this year and the life in retirement you’re working toward. When seen in that light, budgeting can be remade into an affirmative tool, an integral part of a fruitful and constructive financial rhythm aligned with your values and goals. And regardless of where you are financially, consider this: Staying within the reasonable guidelines you’ve set with your budget is like saying “yes” to a fulfilling retirement.

Posted by:

Waypoint Wealth Management

Are You Prepared For The Next Correction?

If you enjoy a good read, we’d recommend Warren Buffett’s annual Berkshire Hathaway shareholder letters. While financial reports are rarely much fun, Buffett’s way with words never ceases to impress. His most recent 2016 letter was no exception, including this powerful insight about market downturns:

“During such scary periods, you should never forget two things: First, widespread fear is your friend as an investor, because it serves up bargain purchases. Second, personal fear is your enemy.”

This actually is a good time to talk about scary markets, since we haven’t experienced a severe one in a while.

Posted by:

Waypoint Wealth Management

How Should We Rank The World?

Maybe you wonder as you peruse the global news headlines with your morning coffee: “What really IS inside my international investments, anyway?” Or “Did Turkey’s stock market really go up by 252% in 1999?” Okay, maybe that’s a stretch and you’re not wondering about that. While we certainly hope that’s not on your mind, we do think it’s interesting to peek into the world of our investments and point out the messy truths of international diversification–especially with this area of portfolios doing very well as we head to the end of the first half of the year.

Let’s expand on last month’s post (here), where we reviewed the size (market cap) of markets worldwide. What if we could see the last 20 years’ annual performance, in order, for 41 various countries across the globe? More importantly, what can we learn from it? The picture below ranks the annual stock market performance for developed global markets (from highest to lowest) over the last 20 years:

Click here to view an enlarged image

What can we take away from an image like this, to help us to be better investors? > SEE MORE

Posted by:

Pete Dixon, CFP®

Partner and Advisor

A World of Opportunities

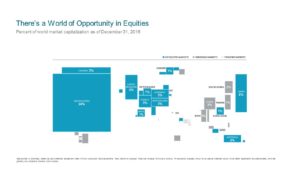

How do we measure the world? Thinking only in terms of a country’s landmass can distort investment decisions. Directly comparing the markets of all nations produces some surprising results. Measures such as population, gross domestic product, or exports do not directly indicate the size or suitability of investments in a market.

This following illustration is one of our favorites and shows the balance of stock (equity) investment opportunities around the world. The size of each country has been adjusted to reflect its total relative “capitalization.”

Click here to view an enlarged version

Of course, the world is in motion— > SEE MORE

Posted by: