Can You Relate To Any of The “Five Stages of Retirement”?

“Retirement is a journey with five distinct stages, and some people get stuck. Understand them, know which stage you are in, and know how to move forward.” -Alan Spector

I recently attended a conference where I had the privilege to hear from author Alan Spector. He and his partners interviewed hundreds of retirees to discover what creates a fulfilling retirement and wrote a book (or a guide, really) to help others with this life transition. It has numerous stories, exercises, and questions to assist with the non-financial, “life planning” aspect of retiring. Since most of you (our clients) are in or nearing retirement, this is something that I have a deep interest in as well. There are so many great takeaways and lessons the book provides, and I would highly encourage anyone interested to check it out (link here) and/or review their website (link here) to explore this for you or someone you know.

One of the enlightening sections of the book is the “Five Stages of Retirement.” I literally can see the faces of various clients across all stages when I read through these. As I share these with you, see if you can identify yourself with one of these stages (borrowed from the book, with permission from Alan): > SEE MORE

Posted by:

Waypoint Wealth Management

If You Ever Needed More Evidence To Properly Diversify…

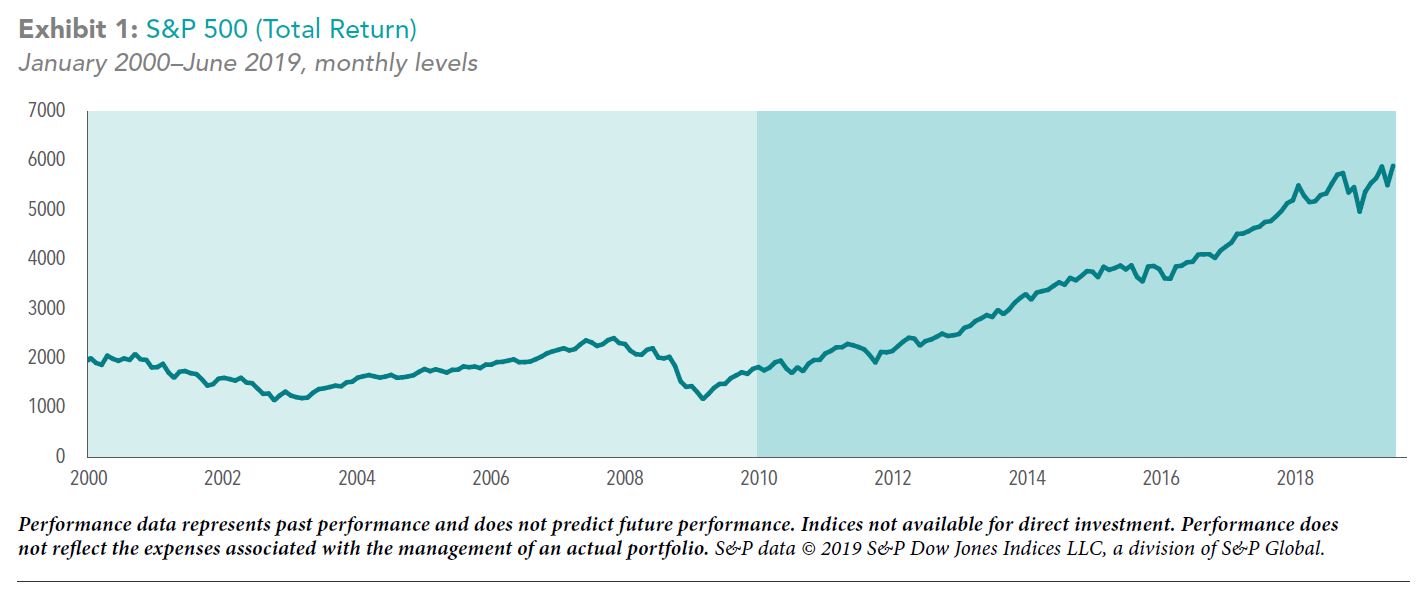

We’ve said it before. There is nothing better than seeing a few concise, clear pictures that demonstrate (again) why as investors we follow the path we do. Dimensional Fund Advisors (DFA) recently came out with a piece that may help you to remember what we absolutely believe to be true. That is (in their words):

- Returns can vary sharply from one period to another

- Holding a broadly diversified portfolio can help smooth out the swings, and

- Focusing on known drivers of higher expected returns can increase the potential for long-term success

Reminders like this can also help us to answer certain questions we should naturally have from time to time. Questions such as “why would I continue to hold an investment that (in the short-term) has simply stunk?” To understand this more, let’s first start by looking at US Stocks (S&P 500) in the first decade of the 21st century (2000-2009) versus the second (2010 until June 2019). Note that you can click on each image to see a larger view:

If you’re like me, you may be glad that US Stocks are held in portfolios in some way, given their run over the last ten years. But what concerns me more is seeing that first decade (at left). What if US stocks go through a long period of time like this, and you’re just beginning to take income now from your portfolio? > SEE MORE

Posted by:

Waypoint Wealth Management

Yesterday, Today, Tomorrow…Where Are We?

I recently had a conversation with my youngest son, who is seven years old. “Daddy.” He says. “A few days ago I built a fort and it was fun.” “That’s great,” I tell him. “When exactly did you get to do that?” “Tomorrow” he replies, before correcting himself. “No, no. It was tonight. I mean yesterday.”

This exchange has been typical as Zachary learns where he and his (very important) events lie on the spectrum of time. Something from the past has occurred but putting it into the context of when exactly that took place (and verbalizing it correctly) is something he is learning to do. Understanding when something took place in the context of time is a bit of a challenge for him right now.

To me, this is similar to the perspective we can have with our investment portfolios and the markets. > SEE MORE

Posted by:

Pete Dixon, CFP®

Partner and Advisor

The Mystery of Annual Returns

Maybe it’s just me, but I love it when I see or hear something that can help you (the client/investor) to get a clearer perspective so that you can tune out the “noise” and worry less about money. For example, if there was something that you could know (maybe again?) that reminded you how irrelevant it is to dwell on short-term returns with investments, would you want to know more about it?

I recently came across an article written by Doug Buchan, from our advisor community (full article is here if you want to read it). He reviewed the last 92 years of market history and made an illuminating observation.

First, he points out (like we have many times before) that the “stock market” (S&P 500) has averaged 10%/year over the last 92 years. You’ve probably heard that before. It’s these next two questions, however, where it starts to get fun:

- Question #1: out of all those years, how many times did the S&P 500 end a year with an average return between 8 and 10%?

- Question #2: out of all those same years, how many times did the stock market have a return higher than 20%, or worse than negative 20%?

Posted by:

Waypoint Wealth Management

What’s the Point of a “Point”?

We’ve often said that watching the market every day has little (if any) benefit to you as a long-term investor. However, we can’t help but hear or read headlines such as “Dow rallies 500 points” or “Dow drops 500 points.” These types of stock movement headlines may make little sense to some investors, given that a “point” for the Dow and what it means to an individual’s portfolio may be unclear. Also, events such as a 500-point move do not have the same impact on performance as they used to. With this in mind, let’s take a look at what a point move in the Dow means and the impact it may have on an investment portfolio.

Impact of Index Construction

The Dow Jones Industrial Average was first calculated in 1896 and currently consists of 30 large cap US stocks. The Dow is a “price-weighted” index, which is different than more common “market capitalization-weighted” (which is simply a product of its stock price and shares outstanding) indices.

An example may help put this difference in methodology in perspective. Consider two companies that have a total market capitalization of $1,000. Company A has 1,000 shares outstanding that trade at $1 each, and Company B has 100 shares outstanding that trade at $10 each. In a market capitalization-weighted index, both companies would have the same weight since their total market caps are the same. However, in a price-weighted index, Company B would have a larger weight due to its higher stock price. This means that changes in Company B’s stock would be more impactful to a price-weighted index than they would be to a market cap-weighted index. > SEE MORE

Posted by: