Geopolitical Tensions and Your Portfolio

It’s quite an understatement to say that it has been hard to watch the atrocities in Ukraine, as Russia continues to invade them. This is undoubtedly one of the most significant geopolitical events in decades. As we reflect on the news, we are primarily concerned about the countless innocent lives that will be impacted by this war. Our thoughts and prayers go out to any of you that have friends, family, or loved ones in the region.

As we look at the financial impacts, Geopolitical events like military or economic conflicts can affect stock markets in many ways. These events are normally widely followed by investors. As you know, we believe current market prices quickly incorporate expectations about the effects of these events on economies and companies. Our investment approach centers on using information in current market prices rather than trying to outguess them.

While we can’t predict what happens next or what future headlines will read, we know that this could cause you to wonder about the stock side of your portfolio. As in all crises, we apply our evidence-driven approach to planning and investing to help you navigate these uncertain times. It’s important to remember we have worked with you to develop a plan which takes uncertainty like this into account. With that said, we wanted to pick up from February’s message with a few other things to keep in mind related to our economy, volatility, and inflation:

- US Economic Conditions: The U.S. economy remains strong with low unemployment, significant job openings, and positive trends coming out of the pandemic. Although the near-term impact to both the markets and your portfolio is uncertain, we know that markets price in new information quickly and tend to recover even from geopolitical situations such as this.

- Volatility: If you do decide to watch regularly, markets likely will continue to be more volatile, which means that we should expect to see mid-to-high single-digit swings (both big gains and big drops) in the markets. Again, this happens from time to time.

- Inflation: As the West reacts with trade and monetary restrictions, we could see continued supply constraints of oil and gas as well as agricultural and metal supplies. This is leading to higher commodity prices. We’re already seeing higher prices at the gas pumps, and stores could increase the level of perceived inflation, taxing consumers, and leading to lower demand for goods and services.

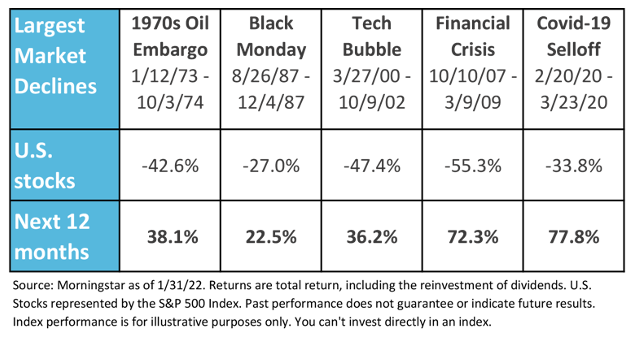

Although the near-term impact to both the markets and your portfolio is uncertain, we know that markets price in new information quickly and tend to recover even from geopolitical situations such as this. The chart below provides some perspective on how markets have performed after various crises:

If you’d like to review this in more detail, or if you have any questions on how movements like this may impact your plan, please don’t hesitate to contact us.

Posted by: